Uh Oh, There’s High Public Support for Price Controls

Thank you to those of you who have pre-ordered or asked for review copies of The War on Prices. Over recent days, sales have surged ahead of the May 14th publication date, and the book is currently the #1 New Release in Macroeconomics and in Inflation on Amazon.

Results from a new poll suggest the public is very open to the government controlling more prices across the U.S. economy. The poll, conducted by YouGov and commissioned by Blueprint and The Liberal Patriot, surveyed over 4,000 voters in spring 2024 to gauge sentiment on 40 policy ideas either proposed or implemented by President Biden or President Donald Trump, ahead of this year’s presidential election.

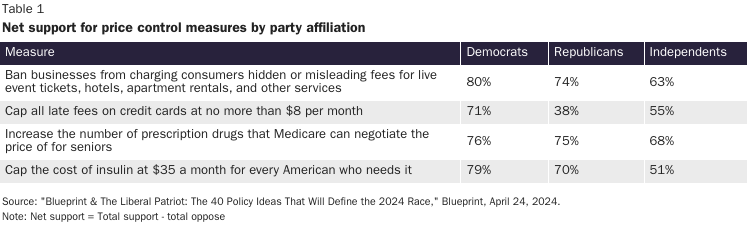

Of the top 10 policies by net support, five call for direct price controls or extending government power to affect prices. These include measures like banning a range of “businesses from charging…hidden or misleading fees” (76 percent net support), allowing Medicare to negotiate more prescription drug prices (75 percent), capping the cost of insulin (74 percent), and tightening the ceiling on credit card late fees to $8 (55 percent net support).

These supportive attitudes towards price controls are broadly bipartisan. As Table 1 below shows, with the exception of Republicans and credit card late fees, all four of the policies discussed above have a net approval of over 50 percent. Banning junk fees, having Medicare negotiate more prescription drug prices, and capping the cost of insulin gets overwhelming support from both Republicans and Democrats too.

This support isn’t limited to just additional fees and healthcare—another recent study shows that voters are rallying behind rent control as well. Authors Christopher Elmendorf, Clayton Nall, and Stan Oklobdzija aimed to gauge public opinion on addressing housing affordability. They surveyed 5,000 participants across political affiliations, including 51 percent Democrats, 32 percent Republicans, and 16 percent who identified with other parties. Their results imply that voters overwhelmingly favor rent control, with over 85 percent of respondents supporting capping rental prices as a means of making housing cheaper.

Now, it’s true that this price control support may be widespread but weakly held. It’s almost certainly the case that, for most voters, junk fees or charges aren’t the main issue that keeps them up at night. Yet it’s perhaps unsurprising that, after a period of high inflation, voters are still worried about high prices and find themselves open to apparently simple measures to contain them.

Particularly because, when inflation is high, politicians face strong incentives to rubbish the idea that it is a macroeconomic phenomenon worsened by government fiscal and monetary stimulus, instead claiming inflation reflects corporate greed, market power, or one-off shocks in certain sectors. The President has been leading the charge on just these narratives. And, depressingly, his message is getting some cut-through. Polling now regularly suggests the public overall see corporations chasing profits as the primary boogeyman for inflation.

As we explain in our upcoming Cato book, The War on Prices, this can all make high inflation a breeding ground for support for government price controls. If you buy the idea that our increasing living costs reflect profit-puffing from companies with market power, then capping specific prices has a certain logic to it.

The problem is that this explanation for inflation is a myth. Our book goes into great depth about this and other misconceptions about the recent inflation. It then walks through the history and economics of many damaging forms of price control, showing they create widespread inefficiencies, diminish the quality of products, and encourage black markets. There’s a reason economists consistently oppose price controls.

We must hope the public’s flirtation with price controls (unlike the recent inflation) is transitory. You can help change minds by gifting someone our forthcoming book.

For more on price controls and misconceptions about the recent inflation, you can pre-order The War on Prices today.