50th Anniversary of Hayek's Nobel

The Austrian showed the importance of the market price mechanism

Fifty years ago today, on October 9th 1974, Friedrich Hayek was announced as a winner of The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel.

The prize committee recognized Hayek’s “pioneering work in the theory of money and economic fluctuations and…penetrating analysis of the interdependence of economic, social and institutional phenomena.” The prize would cement Hayek as one of the most important economic and political theorists of the 20th century.

Much has been written about Hayek’s numerous contributions, but one of his simplest yet most profound insights is presented in the classic paper The Use of Knowledge In Society. It’s a theme crucial to The War on Prices.

A market economy will be more efficient than a centrally planned one, Hayek concludes. Why? Knowledge. Hayek argued that the information needed to allocate resources efficiently in an ever-changing world is dispersed across millions of people. It’s often local, personal, and hard to fully explain. Yes, some knowledge is certainly technical or "scientific” - it can be written down as instruction. But a lot of what we do and how we operate reflects highly personal experience and local understanding.

An estate agent will know about the quirks of their local housing market, the individual shop manager has the most detailed knowledge of how to motivate their difficult staff members, and a specific consumer knows that she prefers one cookie over another, even if she cannot explain why. This practical, on-the-ground information simply can’t be collated by government. A central authority will therefore only ever have access to a tiny fraction of the knowledge that goes into making economic decisions. This “knowledge problem” means that central planning tends to inefficiency and, so, relative poverty.

Fortunately, a market economy is able to harness that knowledge without requiring a central authority to try collating uncollectable information. That’s because every time someone makes a decision based upon their preferences—whether buying eggs or hiring staff—it feeds into market prices. Prices, according to Hayek, thus act as signals that reflect all knowledge, including the dispersed, tacit knowledge held by individuals.

Furthermore, when circumstances change, new local knowledge can quickly be communicated and transmitted through market prices without the rest of us needing to know all the underlying details. Egg prices might rise due to a localized bird flu, but more distant consumers and other producers need not follow the epidemiology of the disease in deciding how to react. Consumers adjust to the higher egg price from this supply-shock in stores by buying fewer, while other producers have more of an incentive to increase their own supply. That process helps supply and demand equilibrate. Dynamic market prices thus allow us to coordinate millions of individual decisions relatively efficiently, alleviating the “knowledge problem” without central direction.

Hayek recognized that market prices are thus crucial to both our economic resilience and ongoing prosperity. He writes:

The whole acts as one market, not because any of its members survey the whole field, but because their limited individual fields of vision sufficiently overlap so that through many intermediaries the relevant information is communicated to all. The mere fact that there is one price for any commodity—or rather that local prices are connected in a manner determined by the cost of transport, etc.—brings about the solution which (it is just conceptually possible) might have been arrived at by one single mind possessing all the information which is in fact dispersed among all the people involved in the process.

….

The marvel is that in a case like that of a scarcity of one raw material, without an order being issued, without more than perhaps a handful of people knowing the cause, tens of thousands of people whose identity could not be ascertained by months of investigation, are made to use the material or its products more sparingly; that is, they move in the right direction.

Few governments these days attempt to engage in direct central planning, of course. Nevertheless, although Hayek’s essay wasn’t a direct policy document, its insights about the “knowledge problem” provide at least three valuable lessons for modern governments:

Support decentralized systems: Governments should prioritize policies that allow individuals and businesses to act on their local knowledge. This ensures greater adaptability and experimentation, leading to efficient outcomes without top-down interference.

Industrial policies require other rationales: Given the “knowledge problem” and how central planning harms efficiency, industrial or spatial planning or favoritism must be justified by other aims, like national security or a direct effort to redistribute activity.

Avoid price controls: Market prices serve as vital signals for coordinating economic activity. By manipulating prices—through controls or regulations—governments distort these signals, undermining the effective communication of dispersed knowledge.

In short, Hayek’s insights showed us that economic freedom under the law and a system of market prices are essential prerequisites for prosperity.

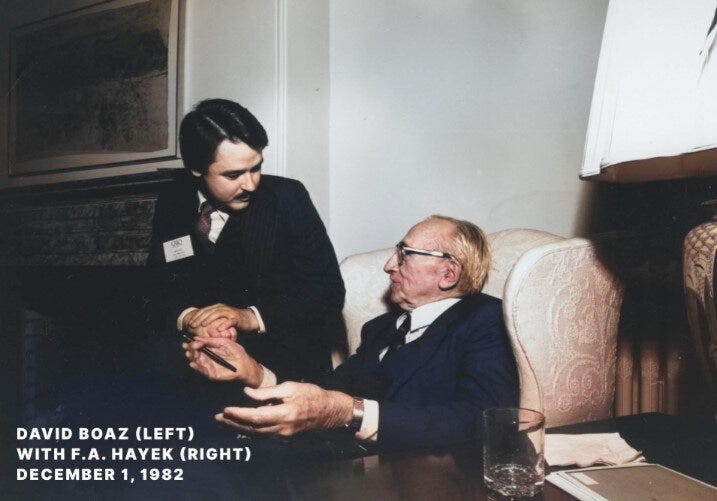

Friedrich Hayek was a Distinguished Senior Fellow at Cato. You can read more by him and about him here.

What a shame that Hayek's insights about the value of decentralized decision-making have not been applied in the form of Pigou taxes and subsidies to the problem of negative and positive externalities, above all the net emission ofCO2 into the atmosphere.